Research Paper on The Current Crude Oil Extraction in Kuwaiti & Worldwide Distribution Network

The Current Crude Oil Extraction in Kuwaiti & Worldwide Distribution Network

Name

Institution

Lecturer

Course

Date

The Current Crude Oil Extraction in Kuwaiti & Worldwide Distribution Network

Introduction

Kuwait is among the GCC nations, and it is popular for exportation of oil products. At the beginning of 2015, Kuwait had an estimated volume of around 101.5 billion lb. of proven petroleum reserves around its territories. This volume was approximately 7% of the world’s number of oil resources. Also, the country owns other oil resources located at PNZ[1] an area that owned on 50-50 basis with the neighbouring country. The neutral zone is assumed to accommodate about 5 billion barrels and when combined with the reserves within its territory the total volume of reserves it owns total to almost 104 billion barrels. Kuwait is a active member of the OPEC and ranked as the fourth exporter of among the twelve member countries of the Organisation (Bacci, 2011). The revenues collected from oil exportation account for almost 50% of the country’s GDP, 95% of total income received from exports and 95% of national government income. Practically, its economic success is attributed to the oil sector used as the backbone of the economy.

The country became politically independent in 1961, but it took close to ten years to have total control of the vast hydrocarbon resources from the American oil companies. The government began by buying shares from the KOC[2] all through the 1970s up to 1975 when it gained full control of the oil company. It was during 1980 when the government of Kuwait created KPC[3] with the aim of having total control of all state-owned petroleum businesses under one entity (Bacci, 2011).Each KPC subsidiary has full control over its principle operations, and it made the oil companies more flexible and ability to expand. KPC has the responsibility of looking for a market and selling the oil products internationally.

The Gulf War that erupted in 1990 was the primary barrier to the process of extraction of crude oil. The petroleum industry managed to resume full production activities after some few months of country liberation. During the early 2000s, Kuwait worked tirelessly to explore and come up with its oil reserves. It was during this period that KPC invested heavily in expanding global attraction through numerous acquisitions. Most of its international ventures concentrated on downstream activities to come up with dedicated markets for its increased levels of crude oil extraction.In 2005, the company discovered super light crude oil which marked a significant milestone for its exploration capabilities. This research report explains the current issues of petroleum production in Kuwait regarding latest production statistics, its reserves, export products and global market network.

OPEC Report on Petroleum extraction

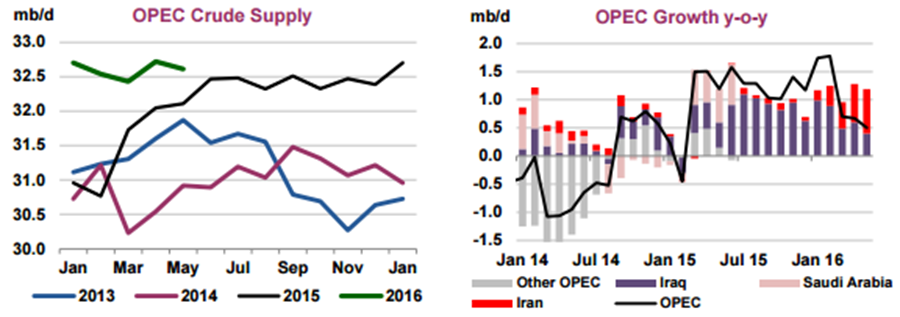

According to the 2016 report by OPEC[4], the global production of crude oil decreased by almost 110kb/d in May to 32.60 mb/d. The flow of power in Iraq reduced by 90kb/d while the marketing scandal in Libya increased production by almost 80kb/d. Kuwait registered the largest increase with its supplies reaching around 120kb/d following the strike of workers during the mid-April. The following groups indicate the supply OPEC crude oil supply and its growth as shown in fig 1.

Figure 1: OPEC crude oil supply (source OPEC, 2016)

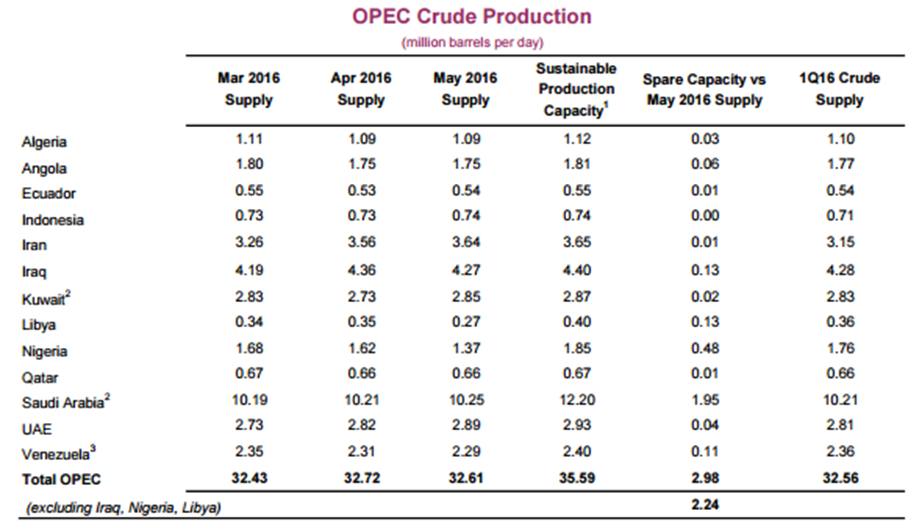

OPEC ranked Kuwait as the second best after Iraq in the production of crude oil crude oil. Its output trend has been increasing since March 2016 up to now as indicated by the data in the table1: the table shows that Kuwait production in the given three months of March, April and may in 2016 averaged 2.8 million barrels per day, above Algeria, Angola, Ecuador, Qatar, UAE, Venezuela, Libya, and Nigeria.

Table 1: current trend of crude oil extraction in Kuwait (source: OPEC, 2016)

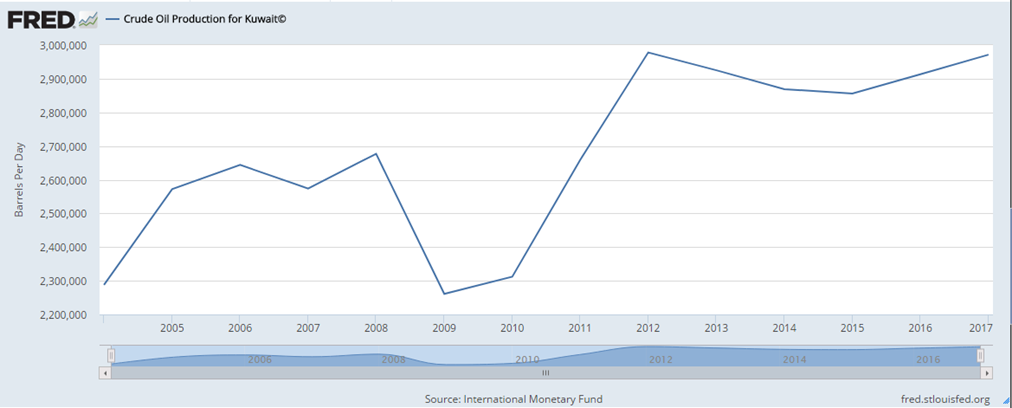

Figure 2: The graph current trend of crude oil extraction in Kuwait (source: OPEC, 2016)

According to the above chart, the volume of production increased from 2005, but the company experienced a downfall in 2009 after facing an economic crisis. From 2010 up to 2012, its output rose to the peak and the trend reduced in 2014 as shown in fig 2. Since the down fall experienced in 2012, the levels of production have gone higher above the pre-2008 levels. As of 2017, the level of production has risen significantly high above the any other year since 2008. Currently, Kuwait produces about three million barrels per day (OPEC, 2016).

Oil extraction in Kuwait

Most of the oil reserves in Kuwait in Burgan Field which is assumed to be the second largest oil reserve among the OPEC member after Ghawar reserve in RSA. According to the report by EIA, Burgan reserve produces light and medium crude oil whose API value ranges between 290 and 350. The oilfield contributes almost half of the country’s current oil production, but according to the estimations by EIA, this field can produce more crude oil products. KPC Company is currently investing heavily in expanding its volume of production by improving the processes of oil recovery. Most of its larger fields of oil production apart from Burgan reserve in the northern part of the country (Al Awadhi, & Nagy Eltony, 2017). According to the recent report by EIA, northern Raudhatain Reserve with the capacity of approximately 450,000 bpd marked as the second largest oil reserve in the country. In the north of the country, Ratqa reserve produces most of the country’s large crude oil product supplies estimated to be in the range of thirteen billion barrels. Some of the other reserves include Sabriya whose production approximated as 100,000 bpd, Minagish reserve and Umm Guddair with the estimated production of about 500,000 bpd. Also, the country has more reserves in PNZ shared with the Republic of Saudi Arabia.

Apart from the extraction of crude oil, Kuwait specialises more in the production of gas from some of the established oil reserves within its territories. Its output of the natural gas is limited to the extraction of associated gas from its petroleum production activities. Although natural gas is one of the key players in its oil industry, the country has vast reserves. According to the 2015 statistical report by OPEC organisation, the capacity of natural gas production was around 1.78 trillion cubic metres in 2014. In 2013, the capacity of natural gas produced was 16.5 billion cubic metres and consumed in the generation of electricity (BRITISH PETROLEUM 2011). Report by EIA shows that energy production from the natural gas in the northern parts of Kuwait is an excellent source of expansion of petroleum industry. Currently, KPC is heavily investing in production from natural gas to about one billion cubic metres of non-associated gas by 2020. The current investment plan by the KPC company includes plans to come up with a 991 billion cubic metres Jurassic gas reserve in conjunction with hydrocarbons(OPEC, 2016). The first phase of this proposed project is already ion operation, and it produces about 4.8 million cubic metres of gas on a daily basis. Both phase two and three of the project are still underway.

The Global Network of Kuwait Petroleum products

Kuwait uses KPC which has numerous subsidiaries to run its operation and foreign assets. The KOTC serves as the primary transportation company by KPC because it helps in the management of the shipment of crude oil, LPG, and refined products all over the world. It operates a modern fleet of the; large crude oil tankers, petroleum tankers on a commercial basis so as to offer efficient distribution network for the country’s oil products. Also, KOTC operates on water transportation to make sure that there is good distribution network of the crude oil through water transport. The PIC (Petrochemical Industries Company) used as a petrochemical distributor operates both nationally and internationally. According to PIC company, close to 70% of the products on its portfolio come from Kuwait.

The Kuwait International Petroleum was established by KPC so as to help in the management of refining and marketing interests of the company all over the world. After launching its new identity, KPI operated its retail services under Q8, and it kept on expanding through numerous acquisitions such as BP’s assets and a joint venture with OKF from Sweden. Also, KPC owns KUFPEC which majorly operates in explorations, establishment and production of unrefined oil and natural gas in the African continent, Norway, United Kingdom and Asia (International Monetary Fund, 2015). Currently, KUFPEC is now working in 15 countries and recently made a crucial investment in energy market at Canada. The primary objective of this company is to assist in the technology transfer and know-how from Canadian expertise in crude oil to support the full exploitation of the country’s crude reserves.

Kuwait controls some of its business activities by entering into contracts with numerous IOCs, but it has less FDI in this sector than any other GCC country. Kuwait has constitutionally banned ownership of its resources and revenues thus complicating the kind of international participation of private sectors in the development of its oil and gas resources. However, leverage of IOC participation is the central part in of the project in the country, and it was founded during the late 1990s to assist the country to achieve its vision of enhancing production capacity to 4m bpd. The involvement of IOC is mainly targeted to develop the complex, northern fields. The government decided to come up with incentives for buying a contract that gives allows the government to own oil reserves fully while the IOCs are paid according to the number of barrels extracted (International Monetary Fund, 2015). However, this mode of incentive was not convincing.

Recently, the government of Kuwait has acknowledged the purpose of technical experience and knowledge the use of ICOs can bring and has made it take measures to start participating internationally in the natural gas nad oil industries through ETSAs (Enhanced Technical and Service Agreements) which are based on performance and improve the incentive for international participation. A good example is Shell company which signed ETSA in 2010 to produce the Jurassic natural gas found in northern parts of Kuwait. However, its development has been delayed by political evolution.

Export of crude oil in Kuwait

According to the report by EIA, the Export of crude by Kuwait is a blend of all its raw products. The basis of this blend formed by products from Burgan reserve involves the heavier and sour crude oil from the reserves in the northern parts. The combination used for export is known as Kuwait Export with a gravity of 31.4 degrees, but it is extremely sour with 2.52% of sulphur. According to the recent report, the country managed to export approximately 2.1 million bpd, most of which was purchased on contract by India, U.S.A, China and Europe. The Asian-Pacific market is assumed to be the prime destination for the export of hydrocarbons in Kuwait. According to Kuwait News Agency, the country aimed China with its exports increasing by almost 13.7% from 2013 to 2014. This trend is expected to increase because KPC signed ten years agreement with Unipec in China to increase the supply to about 300,000 bpd in 2015. According to a report by KUNA, this deal presents the biggest deal of crude oil sales for KPC regarding volume and sales. The agreement is modified on cost-plus commodity price while KPC will use KOTC to supply the crude oil directly. To diversify its customer base, and to offer support to the surrounding areas, Kuwait is still expanding its supplies to African countries to almost two million barrels of crude oil in a month. This ideal prioritises shipment to an African country, and it could also involve refined commodities such as diesel.

Prices of Crude Oil

Although the above contracts ensure the country has secured a market for its increased level of production of crude oil, recent fluctuations in oil prices caused a shock all over the country’s economy. The price of oil fell by almost 40% between June 2014 and December. The drop in oil prices was worst ever witnessed since the world financial crisis. Considering the level of oil supply in Kuwait, KPC has registered a significant improvement that has increased the supply of crude oil outside the non-OPEC members. On the side of demand, some issues weaken economic development across the dominating oil markets such as China, Asian Economies and even Europe resulting in the reduced demand for oil in the short run. The market prices resumed in February 2015, and the cost of Brent had stabilised by April 2015, standing at about 60 dollars per barrel. The cost of local crude oil in Kuwait increased further in February and started dropping by April up to around 60 dollars per barrel (NBK, 2016). According to research, the fluctuation in prices was as a result of rumours that United States oil companies are reducing oil extraction as well as reducing levels of capital investment because of prices not economical for shale programs, a report that was given by the NBK.

The current data indicate that US oil reserves decreased extraction by approximately 39% from the maximum value in 2014. Some of the international producers such as Total, US shale and BP indicate that they are reducing their expenses by 30-40% in 2016, according to the report by the National Bank of Kuwait but the prices of Brent products had reduced to almost 50 dollars per barrel. To reduce the increased volatility, Kuwait has recently resulted in amending its patterns of expenditure. The government reduced its fiscal budget for financial year 2015/16 by 18%, projecting its rates of the expenses to on the average price of oil of 45 dollars per barrel (IBS, 2015).The crude oil in Kuwait is relatively cheap to extract, and this makes KPC make profits even when the prices are low in the market. According to Bader Al Jenae, the decrease in the international prices of oil have not affected Kuwait much as compared to the other oil producing nations because of its low cost of oil extraction and continuous output. However, the increased reliance of the Country on income from oil does not mean that the country needs the prices to remain slightly above 54 dollars per barrel (International Monetary Fund, 2015).

Investment programme

Despite the persistent shocks in the prices of oil that experienced by Kuwait, its government has gone against the expectations and kept on moving forward with the planned investment plans across the country with the primary objective on the gas and oil sector.The government has stated plans to enhance the infrastructural projects and significant projects to develop the oil extraction processes by 2020. According to the ministry of oil, investing heavily in the oil and gas sectors alone will increase the revenues to approximately 100 billion dollars by 2020. The first investment in the energy sector includes the multi-billion dollar refinery project and the Clean Fuels industry which will assist in expanding downstream refining capacity with the country. Also, the projects will help Kuwait in processing o the heavier crude oil to provide the required support for the economy to increase its levels of output from new oil reserves in the northern parts.

Although there have been numerous investment plans that have not been executed over the last ten years, there are signs that the government of Kuwait is committed to meet its targets within the remaining three years before 2020. For instance, the country’s projects experienced a stellar year in 2014 because there were numerous multi-billion deals signed within the ministry of energy alone. Furthermore, apart from investing heavily in the domestic supply of oil in the country, its government is also aiming at foreign asset investments.

Conclusion

The position of Kuwait has one of the largest producer and exporters of crude oil is supported by its vast and proven oil reserves that produce both oil and natural gas. The country is located in the midlle east, neigbouring oil production giants who form majority of the OPEC countries. The success of the KPC oil company in the country has ensured that all the income realised from natural resources has been invested strategically across the country in gas and oil value chain. The country faced a series of political challenges that hindered further investments in the oil and petroleum sector; its government has proven its commitment to reviving the critical programmes and investing heavily in its energy markets, with 2014 marking the many multi-billion signing of deals that marked the government commitment. Although the global prices of oils will have a lot of impact on the government income, the reduced cost of oil production and ample financial sources will protect Kuwait from the downturn. The prodcution levels hit the lowest in 2012, but have since regained and excedded the post 2008 levels with the curent production as at of 2017 being 3million barrers per day. Also, the five-year project investment that is underway will inject the gas nad oil sector with the increased momentum that will propel it towards achieving the set vision 2020.

References

Al Awadhi, M., & Nagy Eltony, M. (2017). Industrial Energy Policy: A Case Study of the Demand in Kuwait. Retrieved 13 May 2017, from https://erf.org.eg/wp-content/uploads/2017/04/0405_final.pdf

Bacci, A. (2011). Kuwait’s O&G Contractual Framework and the Development of a Modern Natural Gas Industry. Retrieved 13 May 2017, from http://www.daoonline.info/public/foto/BACCI%20-%20Kuwaits%20O&G%20Contractual%20Framework.pdf

British Petroleum (2011). BP Statistical Review of World Energy What’s Inside, bp.com. Retrieved 13 May 2017, from http://www.bp.com/assets/bp_internet/globalbp/globalbp_uk_english/reports _and_publications/statistical_energy_review_2011/STAGING/local_assets/pdf /statistical_review_of_world_energy_full_report_2011.pdf.

Central Bank of Kuwait.( 2015). “Quarterly Statistical Bulletin,” Economic Research Department, Volume 31. No. 4

EIA. (2016).Total All Countries Exports of Crude Oil and Petroleum Products by Destination. (2016). Eia.gov. Retrieved 13 May 2017, from https://www.eia.gov/dnav/pet/pet_move_expc_dc_NUS-Z00_mbbl_m.htm

Institute of Banking Studies. (2015).What is the Impact of Lower Oil Prices in Kuwait and on the Kuwaiti Banks?. (2015). Retrieved 14 May 2017, from http://www.kibs.edu.kw/upload/The_Impact_of_Lower_Oil_Prices_in_Kuwait__English_KIBS_1402_2__982.pdf

International Monetary Fund. (2015). Retrieved from https://www.imf.org/external/pubs/ft/scr/2015/cr15327.pdf

National Bank of Kuwait. (2016).Kuwait Economic Brief. (2016). National Bank of Kuwait. Retrieved 14 May 2017, from http://www.kuwait.nbk./InvestmentAndBrokerage/ResearchandReports/$Document/MonthlyBriefs/en-gb/MainCopy/$UserFiles/NBKKuwaitEconomicBriefMarch2016.pdf

OPEC. (2016).International Energy Agency. The United States of America. Retrieved from https://www.iea.org/media/omrreports/fullissues/2016-06-14.pdf

[1] PNZ- Partitioned Neutral Zone

[2] KOC- Kuwait Oil company

[3] KPC -Kuwait Petroleum Corporation

[4] OPEC- Organization for petroleum exporting countries